When the CBK Amendment Bill, 2021 was signed into law last year, the Central Bank was given powers to police the lenders. One way the digital lenders were considered a nuisance was contacting people the borrowers know as a way of shaming them and thus forcing them to pay their loans. This is why the bill signed into law and the Data Protection Regulations, 2021 are crucial in protecting borrowers. The Office of the Data Protection Commission (ODPC) plays a very important role in ensuring this is enforced.

The lenders are no longer allowed to contact any person or share the borrower’s data with other parties without consent from the borrower. It looks like the lenders are still not obeying this which is an offense under Section 61 of the Act.

According to the data regulator, it is investigating up to 40 digital lenders after receiving complaints from consumers. Branch, Zenka and Tala are some of the digital lenders under investigation. If found to be in breach, they face a fine of Sh5 million or up to one percent of their annual turnover.

Immaculate Kassait, the Data Protection Commissioner, said that a preliminary audit is currently underway to determine if any of the leonard misused creditor’s data to their advantage.

“The office of the Data Protection Commission wishes to notify the public that it is conducting preliminary document assessment and audit on 40 Digital Credit Providers whose practices regarding the processing of personal data has been raised to the Data Commissioner as complaints by various members of the public,” said Ms Kassait yesterday.

The firms have been accused of resorting to “debt shaming” tactics to recover loans and breaching the confidentiality of personal information.

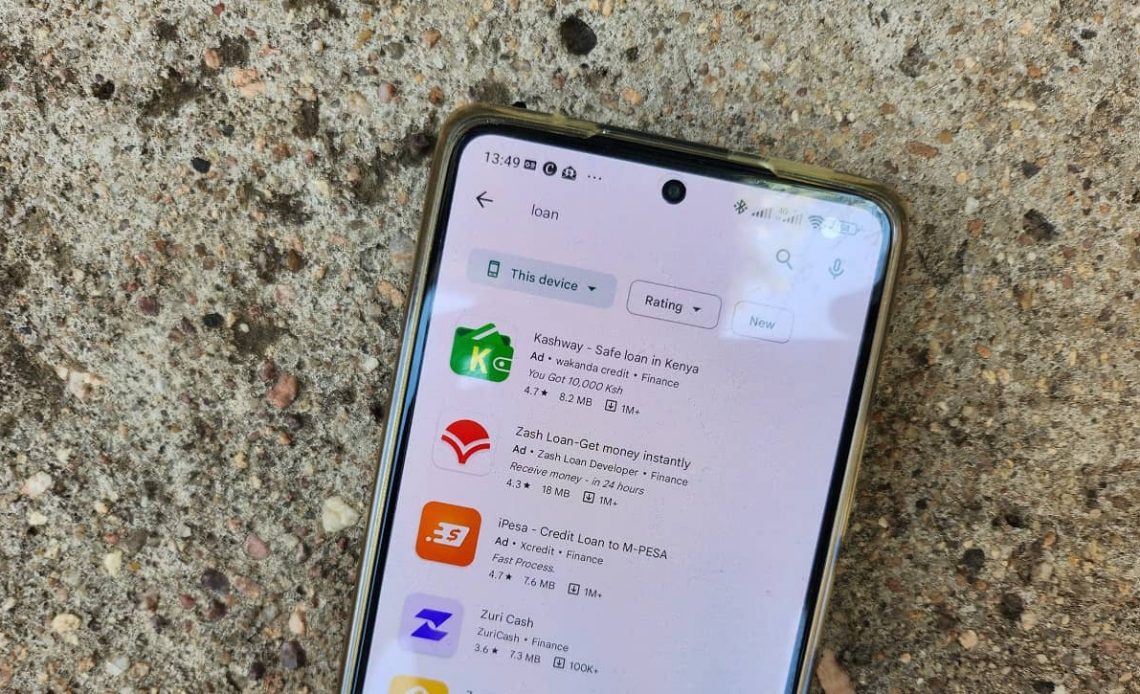

Besides the above named lenders, the others being investigated are APESA, ASAPKASH, Cash Sea, Collectplus, Coopesa, Credit Kes, Credit Moja, Deltech Capital Limited, DIRECT CASH, Fairkash, Flashpesa, Flexi Cash, Hela Credit, Hikash, IKASH Connect, Instarcash, IPESA, KASH LOAN, KASHBEAN, KASHPLUS, KASHWAY, KESLOAN, LEMON KASH, Lioncash, M-Credit, Metaloan, Mokash, PAPCASH, POCKET CASH, PREMIER CREDIT LTD, ROCKET PESA, Senti, Skypesa, Wakanda Credit, Zash loan, Zenka Digital Limited and Zuri Cash.

Some of these are accused of using debt collection agents to pursue the borrowers either by informing their friends and family or by threatening to tell their employers.

“As of September 30, 2022, ODPC had received 1030 complaints, the office admitted 555 of these cases including 299 which were on digital lending, representing 54 percent of all cases admitted,” Ms Kassait said.

Confidentiality expected from digital lenders

The digital lenders are expected to have policies, procedures, and systems to ensure the confidentiality of customer information and transactions.They are also not allowed to share customer information with any person without the customer’s consent.

Read: These are the 10 Mobile Loan Lenders Approved by the Central Bank of Kenya