A few days ago, we told you about Cashlet, the new app by Sycamore Capital. The app was officially unveiled in Kenya after the company successfully exited the CMA Sandbox.

Cashlet makes it easier for kenyans to save and invest in money market Funds (MMFs). When it comes to investing in MMFs, the norm has always been to invest in the different options available through different platforms as there were no easily accessible options that had a number of select MMFs centralized in one place. This made the processes of choosing difficult and investing in different MMFs was equally as complicated as a result.

With Cashlet, you can save and invest into MMFs from as little as ksh 100. This makes saving and investing accessible to a big part of the population. You can earn between 11-15% interest on your savings. Cashlet has partnered with licensed Kenyan fund managers including ICEA Lion Asset Management, Etica Capital, and Orient Asset Managers.

Introducing the Cashlet App

The Cashlet app is a user-friendly mobile app available on both iOS and Android.

The core function of the app is to help you save and grow your money. Since you can save as little as ksh 100, this is perfect for anyone, even those in informal sectors. You can use the app to participate in the popular 52 week savings challenge where you save from Ksh 100 every week into your MMF. You can deposit money to your account through M-pesa or through bank transfer. M-pesa transfers are done through the Cashlet app.

Cashlet is regulated by the CMA, is secure and requires no paperwork to get started. Just download the app, set up an account in just a couple of minutes and you are good to go. You will need your ID close by when creating an account as a scan of the same is required to activate your account.

All your information is encrypted with bank-grade security encryption to ensure no unauthorised access.

Key Features and Benefits

- Easy to Get started: The biggest advantage of using Cashlet is there is no paperwork to get started. This saves you a lot of time and hassle and all you need is the app and your ID/Passport. Investing has always been quite a hassle for most people given how complex the whole process can get.

- Accessible Entry Point: Since you can save from as low as ksh 100, this makes the saving and investment options accessible for most people. Every time you get some money (any amount above ksh 100), you can deposit it to your account and watch it grow.

- Good interest rates: Your savings earn 11-15% in annual interest as long as you keep them in your account.

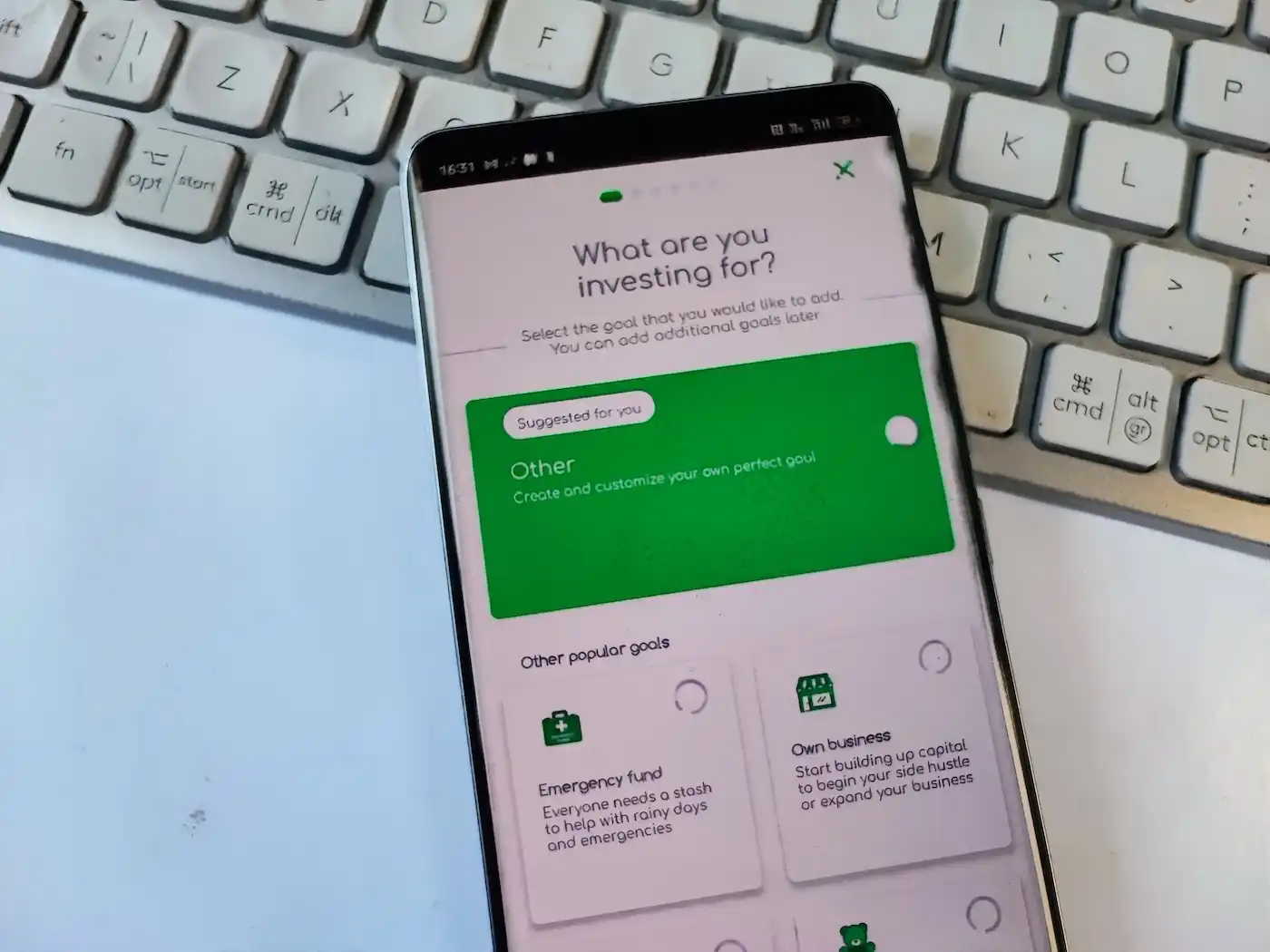

- Track your progress: Through the Cashlet app, you can set savings goals and monitor your progress. For example, you can set an Emergency fund target and work towards saving that amount. The app will break down your total amount into daily, weekly and monthly saving targets to help you attain your goal within the time period you set. You can also track the progress of your investments in MMFs and know how much you earn each day.

- 24/7 Support: Cashlet provides reliable customer support around the clock within the app. Just open a support ticket and you will be able to ask for assistance.

Cashlet Investment Calculator

Cashlet has an investment calculator that lets you see how much your funds will be worth after a certain period. For example, you can see how much you will have in 10 years if you invest with the platform. This is a neat feature that I would recommend to anyone as it gives you an idea of what to expect from your savings. The investment calculator is available through the Cashlet site (https://www.cashlet.co.ke/ ) and I haven’t seen it on the app. This would be a good addition to the app in my opinion.

Partner Fund Managers

As I have mentioned above, Cashlet works with licensed Kenyan fund managers including:

- ICEA Lion Asset Management

- Etica Capital

- Orient Asset Managers

Cashlet Pricing and Fees

Before you download and use the app, you should know about the pricing and fees you may encounter. If your balance is under ksh 20,000, Cashlet will be free to use. For amounts above Ksh 20,000, the platform fee will be ksh 40 and this will be deducted from your balance every month. When withdrawing or depositing to your account, normal M-Pesa fees apply.

For more information, you can visit the official Cashlet website.

Read: What you need to Know about Safaricom Halal Pesa