LOOP has announced the launch of a new 30-day digital loan product. This product is designed to deliver fast, flexible, and transparent access to credit for Kenyans. It adds to LOOP’s growing suite of products, such as LOOP Fle,x which we covered last year.

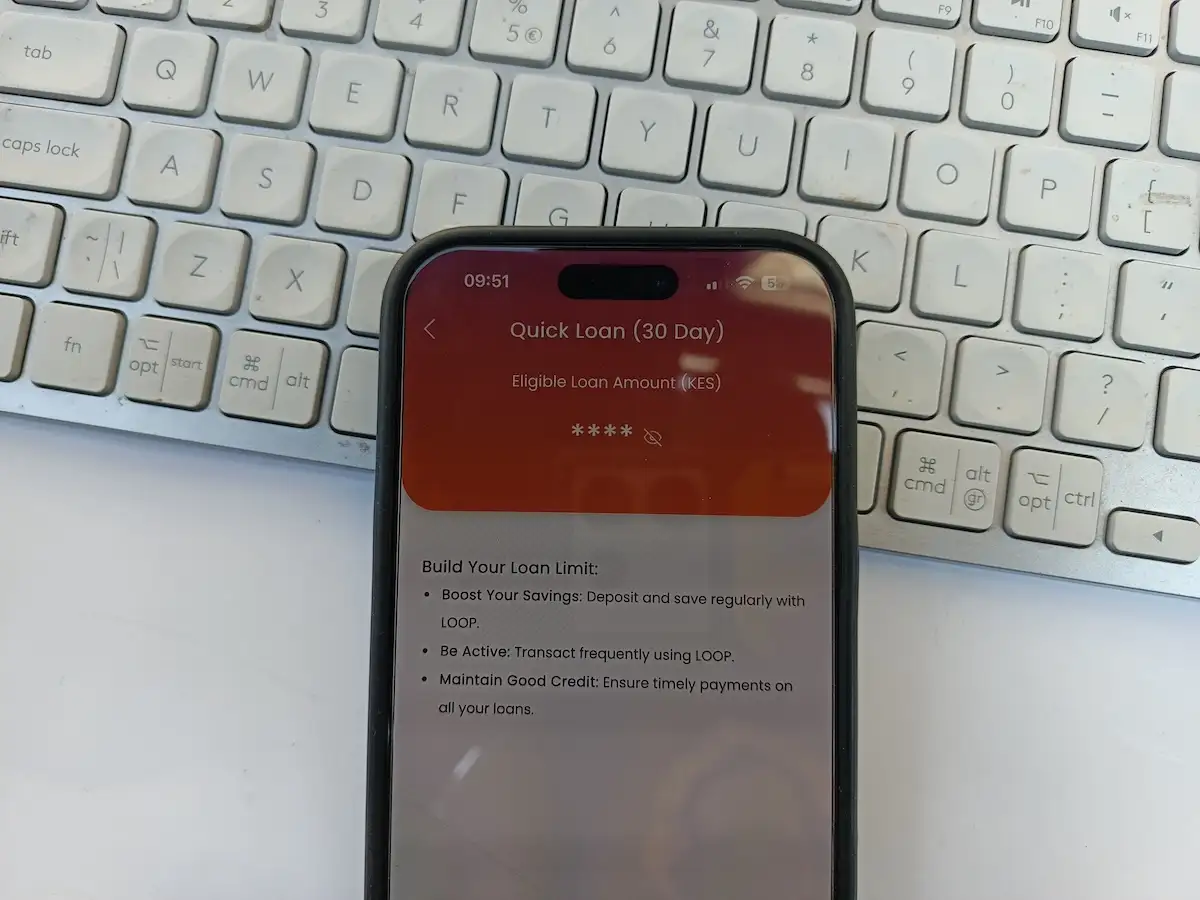

The LOOP Quick 30-Day Loan is now available to all eligible customers with a credit limit and no outstanding overdue balances. It allows users to borrow amounts between KES 2,000 and KES 100,000. The amount is instantly disbursed to their LOOP wallet via the LOOP App.

Key Features of LOOP Quick Loan

Some of the key features of this loan include:

- Fast Access, as funds are disbursed instantly to the customer’s wallet.

- Flexible Topping Up – Borrowers can top up within the first 20 days. This is subject to their credit limit.

- Clear Pricing – A 7% facility fee is charged upfront. If unpaid by day 31, a 7% roll-over fee applies on the remaining principal.

- Excise Duty – 20% excise tax is applied to both the facility and rollover fees.

“The LOOP Quick Loan is about putting control into the hands of our customers,” said Eric Muriuki, CEO of LOOP DFS. “We understand that people sometimes need a boost to bridge short-term cash flow gaps, and now, they can do that directly from their phones.”

A Digital-First Lending Experience

This new loan product is part of LOOP’s broader strategy to build a lifestyle-oriented financial ecosystem. This combines accessibility, innovation, and inclusion. It is part of a growing portfolio of digital-first services designed to meet evolving customer expectations in a mobile-first economy.

To apply, customers can start by logging into their LOOP App, navigating to the ‘Grow’ section. You will see the ‘Quick loan’ option, tap on it, check their loan limit, and accept the loan terms and conditions.

The LOOP Quick Loan adds another tool for financial resilience. It is meant to help users manage daily expenses, emergencies, or short-term needs with greater flexibility.

For these and more stories, follow us on X (Formerly Twitter), Facebook, LinkedIn and Telegram. You can also send us tips or reach out at [email protected].

Also Read: The LOOP Visa Card Unlocks Financial Convenience and Lifestyle Rewards