Every year, financial institutions lose millions of shillings due to fraud. Most of these institutions do not publicly report many of these cases but industry insiders know it is happening and will continue happening for years to come.

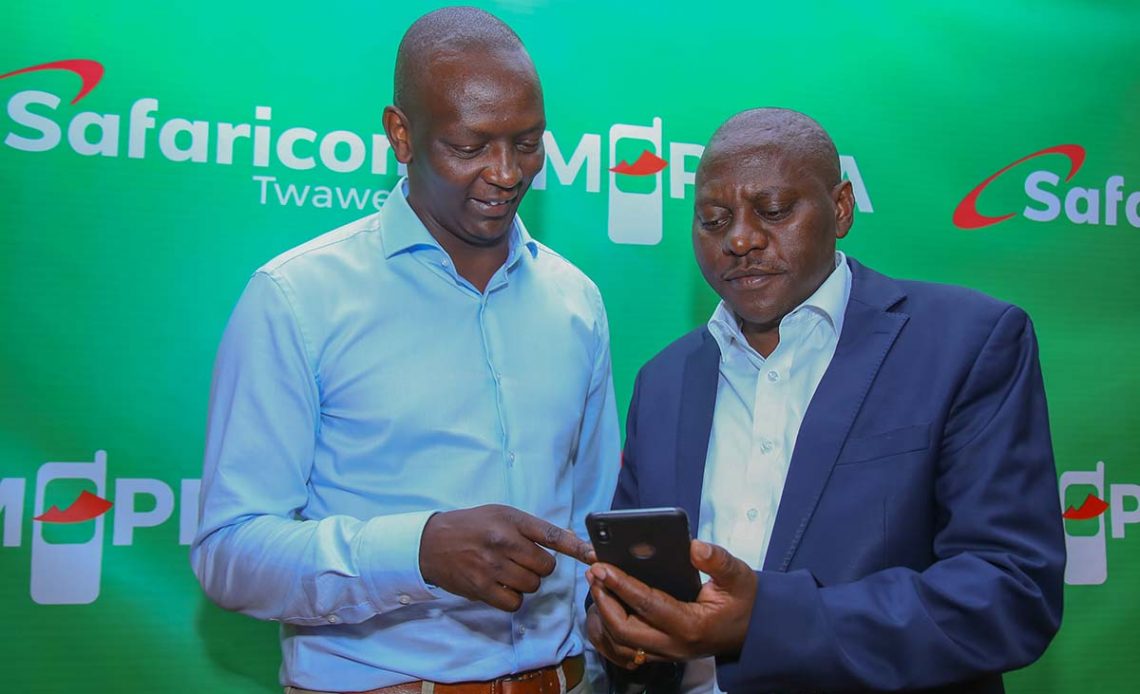

To address this, Safaricom has today unveiled a new fraud intelligence solution made for financial institutions. Safaricom says banks, insurance firms and micro-finance institutions can use this tooL to reduce fraud incidences targeting their customers. This will be possible as this tool will help determine the authenticity of a financial transaction.

“Through the years, we have developed in-house capabilities that have helped us cut down on attempted fraud incidences targeting our customers by more than 75 percent. Today, we are launching a solution that will provide these world-class capabilities to our enterprise customers in the financial sector, empowering them to make more informed decisions when interacting with their customers in the digital space,” said Sitoyo Lopokoiyit, Chief Financial Services Officer, Safaricom.

Besides transaction authenticity, this solution will also provide these financial institutions with capabilities to design their lending propositions, enhance the registration and onboarding of new customers, and managing phone numbers linked to a customer’s account but which may no longer be in use.

Cross Channel Solution

This is a cross channel solution that financial institutions can access through an API that will be provided as part of the Daraja M-Pesa APIs. The three channels we are referring to include USSD, internet banking and smartphone apps.

When a customer tries to log in through any of the channels, the institution will run the phone number through the service to check against parameters such as if a customer’s number has been recently swapped. From here, the institution can then factor in the result of the check to complement internal fraud rules and to make a decision whether to allow the transaction or if to further authenticate the customer through other methods.

Also Read: Using M-Pesa’s Daraja API To Help County Governments Collect Revenue