PalmPay has introduced a new high-yield savings feature on its app, allowing customers to earn an impressive annual interest rate of up to 20%. The company recently celebrated reaching 25 million users on its smartphone app and has successfully enlisted 800,000 businesses to its mobile money agent and merchant networks.

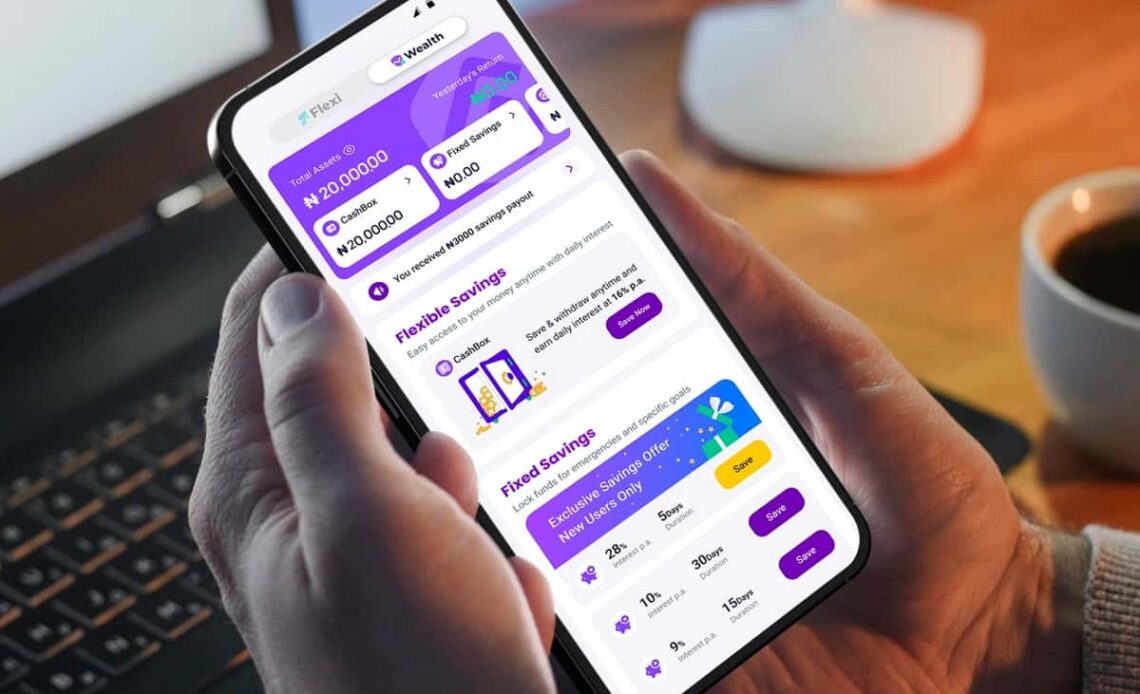

The savings feature on the PalmPay app offers flexible and fixed-term plans, catering to a range of financial goals and timelines. Notably, there is no minimum deposit requirement, giving users the freedom to participate regardless of their financial standing.

One of the standout features of the savings product is the PalmPay Cashbox, a flexible savings plan that provides customers with daily interest payouts. Funds deposited into the Cashbox remain accessible for withdrawal at any time without penalties. Users can enjoy an impressive annual interest rate of 16%, which is calculated based on the Cashbox balance, including both the principal amount and accumulated interest from previous savings.

The Cashbox product also offers an automation capability, allowing users to enable an auto-save function that automatically transfers deposited funds into their Cashbox. This streamlines the savings process, eliminating the need for manual funding and withdrawal. Users can conveniently use their Cashbox balance for transfers and bill payments, enabling effortless wealth accumulation.

For those looking for higher interest rates, PalmPay offers a Fixed Term savings plan with annual interest rates of up to 20%. This product encourages responsible financial habits and serves as a powerful tool to help individuals achieve their financial goals.

Chika Nwosu, the Managing Director of PalmPay Nigeria, expressed the company’s commitment to providing access to high-yield returns for all Nigerians, regardless of their income bracket. This initiative aims to accelerate their journey to financial freedom and stability. The new savings feature aligns with PalmPay’s mission to empower users by offering effective ways to build financial stability and grow their wealth.

PalmPay’s reputation for its user-friendly interface, discounted transactions, and secure network has contributed to its recent milestone of reaching 25 million users and successfully onboarding 800,000 businesses onto its mobile money agent and merchant networks. The company’s reliability was particularly appreciated during a period of cash scarcity earlier this year, as PalmPay seamlessly handled the increased demand for digital payment services.

PalmPay’s focus on harnessing the power of technology enables everyday Nigerians to access top-tier financial services conveniently. By doing so, the company is contributing to a financially inclusive future, ensuring that everyone has the tools they need to thrive financially.

Sofia Zab, PalmPay Global CMO, emphasized the goal of PalmPay to provide savings products that help customers save for the future, invest in their businesses, and protect themselves against unexpected financial challenges. With over 25 million Nigerians relying on PalmPay as their trusted financial partner, the company is dedicated to achieving even greater heights alongside its community of users.

Read: Infinix Partners With PalmPay to launch a digital wallet app dubbed Infinix Wallet