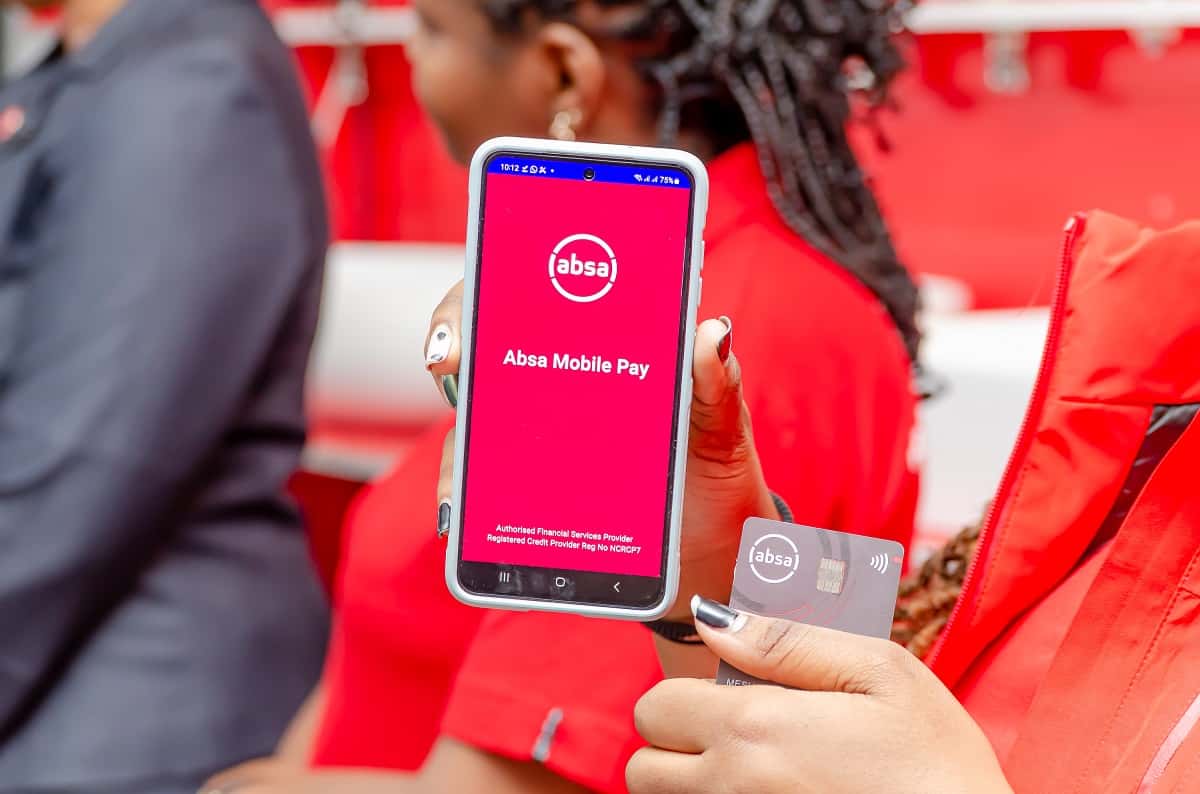

Absa Bank Kenya has announced a new partnership with Visa to launch the Absa Mobi Tap solution, a payment solution that enables small businesses to accept card-based payments using an Android smartphone. This market-first solution leverages the smartphone as a point of sale (POS), allowing customers to conveniently tap their debit or credit cards on an Android phone or tablet to make a payment.

What is the Absa Mobi Tap Solution?

The Absa Mobi Tap solution requires merchants to download the Absa Mobi Tap app from the Play Store, set up their profile, and they’re ready to accept card payments without the need for a traditional PDQ/POS machine.

The payment process is straightforward: the merchant enters the transaction amount, and the customer taps their contactless card on the back of the smartphone, entering their PIN if required to complete the purchase.

As you have probably figured out, the solution utilizes Near Field Communication (NFC) capabilities to facilitate communication between the merchant’s device and the customer’s contactless payment card.

This solution primarily targets small and medium-sized enterprises (SMEs), especially those with mobile operations that previously relied on cash or electronic funds transfer (EFT). Various merchants, such as ride-hailing drivers, restaurants, salons, and hardware shops, have already adopted this technology according to Absa.

Benefits for Small Businesses

Elizabeth Wasunna, Absa Bank Kenya’s Business Banking Director, expressed the bank’s commitment to digital innovation and its focus on providing relevant payment solutions for Kenyan customers and small business owners. Wasunna stated, “As a digitally-led bank, we are excited to introduce another first-to-market solution that provides merchants with an innovative and cost-effective solution for their day-to-day business.”

Wasunna emphasized the benefits for SMEs, stating, “We understand the difficult and challenging business operating environment for many SMEs today and their need to maintain stable cash flow positions, hence Mobi Tap is removing the burden for SMEs to acquire PDQ machines for their payment needs.”

The solution may also be faster than other methods. This will enable faster transactions and hopefully improve customer experience.

Eva Ngigi-Sarwari, Visa Kenya’s Country Manager, commended Absa’s dedication to empowering small and medium-sized enterprises (SMEs) by removing barriers and expanding access to digital payment options. Ngigi-Sarwari highlighted the significance of Mobi Tap in promoting financial inclusivity and leveraging the country’s mobile-first culture. She stated, “The solution allows sellers to take advantage of the technology they already have – mobile phones, which are widely owned throughout the country.”

As part of the Absa Mobi Tap proposition, Absa will offer an installment plan to merchants to purchase NFC-enabled smartphones. This launch aligns with the recent introduction of a Standard QR Code, aimed at boosting digital payment usage by enhancing convenience, speed, and security for service providers and banks.

Read: KCB Group Joins Pan-African Payment System for Cross-Border Transactions in Africa