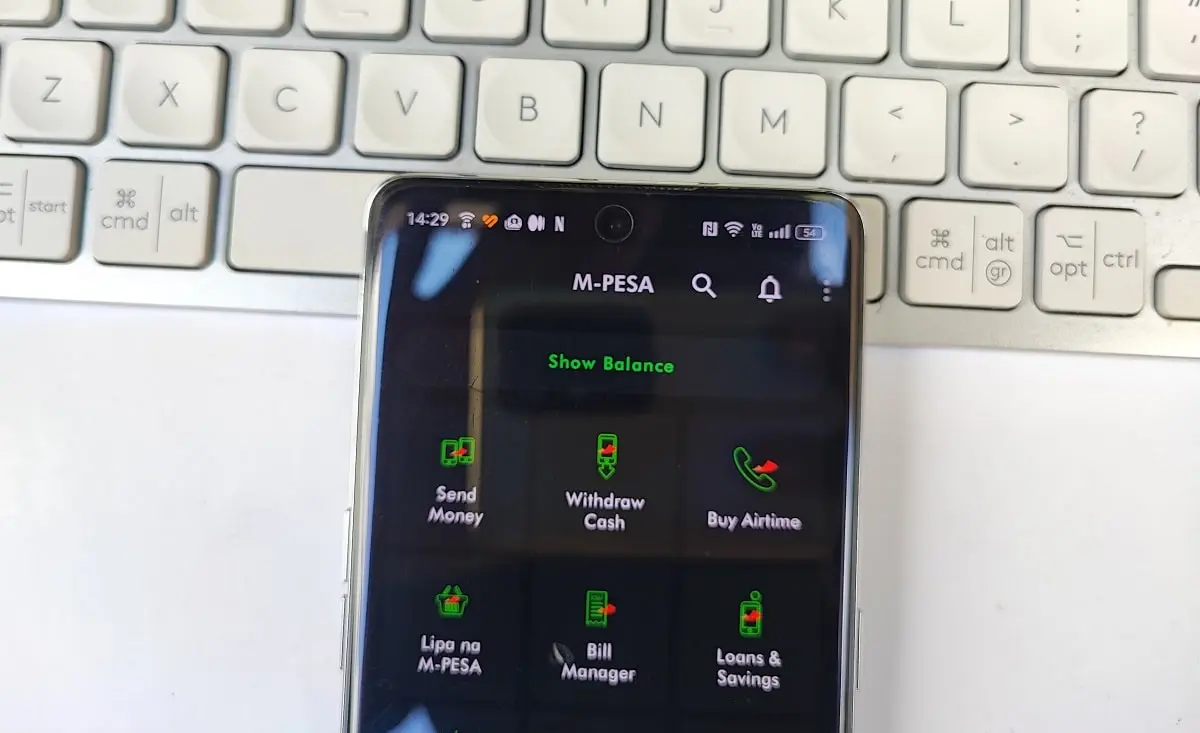

A viral tweet recently brought attention to a reality for millions of Kenyans. Withdrawing just Ksh 200 from M-Pesa, the country’s dominant mobile money platform, can attract a charge of Ksh 29. That’s roughly 14.5% of the transaction amount and that’s before factoring in the fees the sender may have paid.

In a country where mobile money is practically a utility, this raises several questions: Are the transaction fees justifiable? Who is most affected? And is the mobile money sector in Kenya truly competitive?

What the Numbers Say

According to Safaricom’s latest tariff guide for 2025, withdrawing Ksh 200 at a physical agent will cost you Ksh 29. These amounts are not that high, but for low-income earners who rely on micro-transfers, the fees add up significantly.

Have a look at this snapshot of some transaction fees:

- Ksh 100 withdrawal = Ksh 11 fee (11%)

- Ksh 200 withdrawal = Ksh 29 fee (14.5%)

- Ksh 500 withdrawal = Ksh 29 fee (5.8%)

From this, a higher percentage is charged as fees, the lower the transaction value.

Double Charge Dilemma

The person sending you money is also likely charged, especially if it’s a transfer to a non-registered M-Pesa user, or if it involves other costs such as bank-to-M-Pesa fees. This means both parties lose money on a single transaction, all in the name of financial inclusion.

Safaricom still dominates Kenya’s mobile money space. Even though the platform has opened up access to financial services, its dominance has also led to monopoly-like conditions. With that, there is very little pressure to lower its transaction fees.

Experts have long argued for the need to treat M-Pesa as a utility and regulate it accordingly. Just as electricity or water providers are regulated due to their essential nature. Shouldn’t mobile money, especially one that handles over Ksh 30 trillion annually, be subject to more oversight?

Digital Finance and Affordability

As Kenya pushes forward with digital finance inclusion goals, affordability must be part of the conversation. Innovation without equitable access risks slowing down financial exclusion. This is not something to look forward to, as it is the very thing mobile money was meant to solve.

Some of the ways to address the issue:

- Tiered pricing models for low-income users

- Fee-free withdrawals below certain thresholds

- More competition in mobile money services

Verdict

The tweet may have been short, but the raised important points. The cost of convenience in Kenya’s mobile money space is high. As Kenyans rely on platforms like M-Pesa in their financial lives, we need to have a discussion on fairness, affordability, and regulation.

Also Read: Kenyan Youth Prefer Mobile Money Over Banks, World Bank Report Reveals