PalmPay has been recognised in CNBC and Statista’s 2025 Top 300 Fintech Companies in the World list. This marks the second year in a row that PalmPay has earned a place among the world’s most innovative and impactful financial technology firms.

If you have a startup you want featured on TechArena, let us know through this contact form here.

The selection is based on a rigorous evaluation of thousands of companies globally, assessing growth, innovation, market penetration, and impact. This year’s list includes a mix of global leaders, including Revolut, Nubank, and Ant Group, alongside rising stars from high-growth markets, underscoring the growing influence of emerging-market fintechs like PalmPay.

PalmPay’s inclusion reflects its continued momentum as one of Africa’s leading fintech platforms. With over 35 million registered users and up to 15 million transactions processed daily, the company offers a comprehensive suite of digital financial services tailored to the needs of underserved communities.

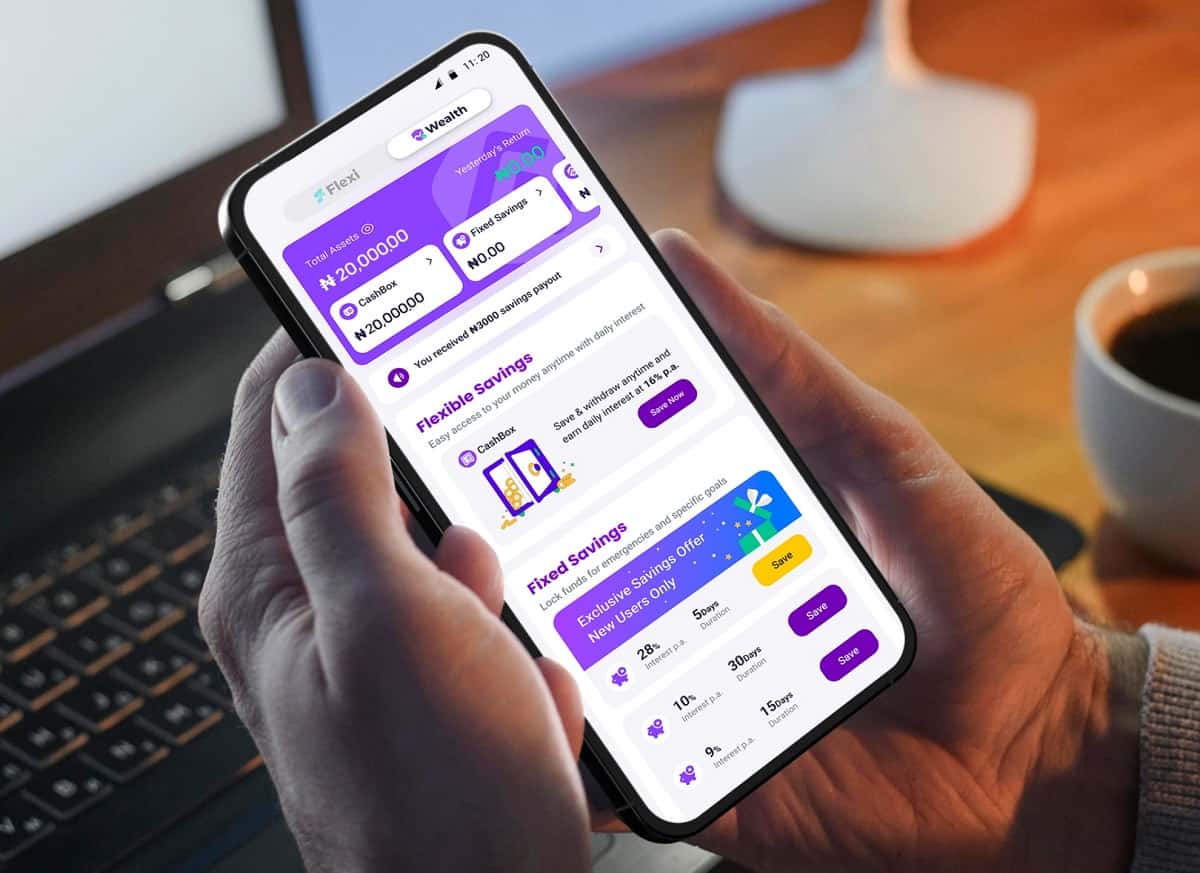

In its main market, Nigeria, PalmPay operates as a full-service neobank, offering consumer financial services such as transfers, bill payments, credit, savings, and insurance – all accessible through its user-friendly app and supported by a nationwide network of over 1 million agents and merchant partners. The company also provides POS and API-driven B2B solutions tailored to the needs of merchants and enterprise clients.

“To be recognised as one of the world’s top fintech companies by CNBC and Statista is a powerful affirmation of our mission to build a more inclusive financial system,” said Sofia Zab, Founding Chief Marketing Officer at PalmPay. “Through cutting-edge technology, deep local distribution, and a customer-first mindset, we’ve built Nigeria’s leading neobank. As we scale PalmPay to more emerging markets, including Tanzania and Bangladesh, our focus remains on closing financial access gaps for everyday consumers and businesses, while expanding the partner ecosystem that fuels our reach and impact.”

As part of its broader expansion strategy, PalmPay recently launched in Tanzania and Bangladesh through a smartphone device financing model that serves as an entry point to digital financial services.

“PalmPay is building a neobanking platform tailored to the realities of emerging markets,” said Jiapei Yan, Group Chief Commercial Officer at PalmPay. “We are creating the infrastructure for a connected digital economy – where people and businesses can thrive through reliable, inclusive financial tools. This recognition from CNBC and Statista affirms our progress and also the scale of the opportunity ahead. As we expand across more emerging markets, we are committed to creating lasting value for our users, partners, and the communities we serve.”

PalmPay’s inclusion follows another major recognition earlier this year: the company ranked #2 overall and #1 in the financial services sector on the Financial Times – Africa’s Fastest-Growing Companies 2025 list. The ranking, based on revenue growth between 2020 and 2023, highlighted PalmPay’s rapid scale and market traction across Africa.

PalmPay currently operates in Nigeria, Ghana, Tanzania, and Bangladesh, and is expanding its presence across Africa and Asia through device financing, digital banking, and B2B payment services. Backed by a robust neobanking platform and a partnership-led approach, the company is committed to shaping the next chapter of inclusive financial growth.

For these and more stories, follow us on X (Formerly Twitter), Facebook, LinkedIn and Telegram. You can also send us tips or reach out at [email protected].

Also Read: PalmPay Launches Debit Card in Nigeria in Partnership With Verve