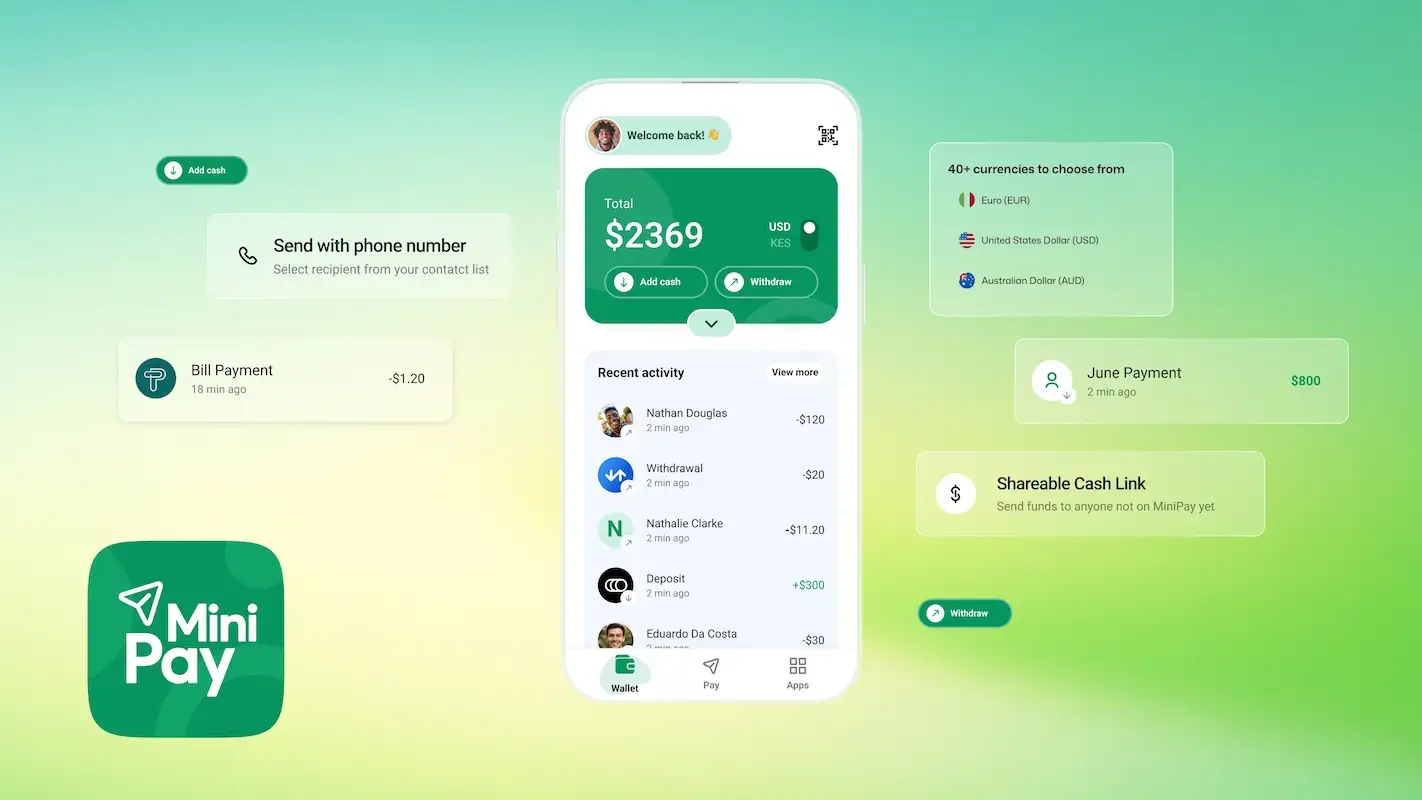

Opera’s stablecoin wallet MiniPay, once only accessible via the Opera Mini browser, is now a standalone application available globally on iOS and Android. Built on Celo’s Ethereum Layer-2 blockchain, MiniPay is designed to make sending and spending stablecoins as easy as sending a text message.

MiniPay was launched back in 2023 and has activated over 7 million wallets. Its Android standalone version released just last October has already surpassed 1 million downloads. The app supports all popular stablecoins like USDT, USDC, and cUSD. It allows users to store value and make low-fee, near-instant transfers globally.

“MiniPay becoming a standalone app is a crucial step in helping people around the world access the global dollar system,” said a spokesperson from the Opera team.

Tailored for African Markets

Unlike most crypto wallets that are built for crypto-savvy users, MiniPay is designed for real-world use cases in emerging markets. The team says the app was created “around the realities of mobile-first users,” offering services like airtime purchase, bill payments, and local merchant transactions through a suite of Mini Apps built by local developers.

In Kenya, Ghana, and Nigeria, MiniPay integrates with popular mobile money providers like M-PESA, MTN MoMo, and Airtel Money through partnerships with on-ramp services such as Yellow Card, Cashramp, Transak, and others. Users can deposit and withdraw in local currency, often in under 60 seconds.

“We see MiniPay not as a competitor [to M-PESA] but as complementary… offering something different: a stablecoin wallet that connects users to global value flows,” the Opera spokesperson noted.

To address crypto’s steep learning curve and security risks, MiniPay adopts a Web2-style UX. Users can be onboarded using their Google or iCloud accounts and their phone number. The wallet’s account abstraction model encrypts private keys and stores them securely. This allows easy recovery without compromising custody.

This ease-of-use is proving especially appealing to remote workers, freelancers, and underbanked communities, who often lack access to global payment networks or suffer from remittance fees averaging 6–7%.

“MiniPay is a self-custody wallet – we don’t hold user funds. Instead, users are in full control, and regulated partners handle KYC when needed,” Opera clarified.

Growing Ecosystem and Future Outlook

MiniPay’s strength lies not just in its wallet functionality but in its growing ecosystem of Mini Apps, which includes everything from airtime purchase and utility bill payments to donations and e-commerce. While Opera didn’t disclose the number of African users or average transaction sizes, the company says airtime and bill payments remain the most popular use cases so far.

As for future merchant payments, Opera is taking a phased approach.

“Our focus right now is on optimizing the experience for end users through partnerships with Mini Apps delivering relevant utility,” Opera shared.

Also Read: Mdundo Surpasses 125,000 Subscriptions on MiniPay

1 Comment

MTN deposit