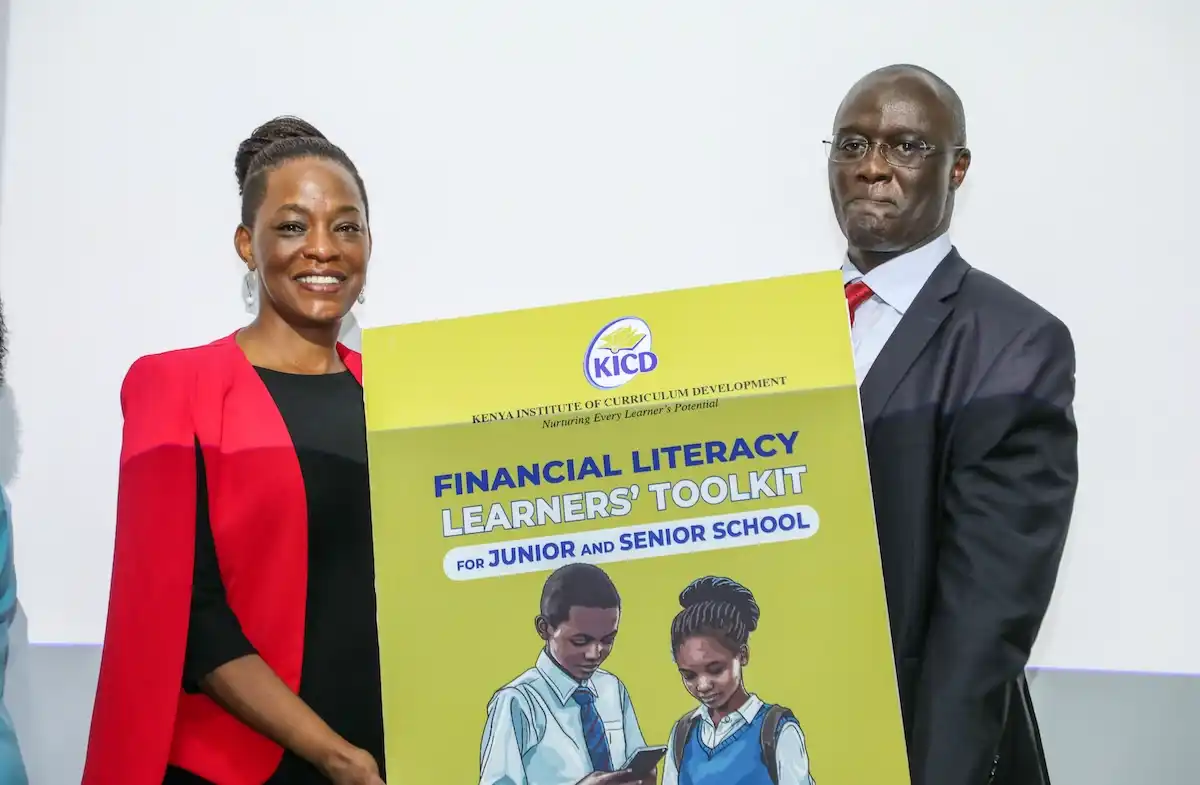

M-PESA GO, Old Mutual and the Kenya Institute of Curriculum Development (KICD) have today unveiled a financial literacy online toolkit, targeting students in junior and senior schools.

This learner’s toolkit comes after the launch of a teachers’ training platform in June this year to empower teachers with the necessary skills on matters finance therefore enabling them to pass the same to the young ones.

The program includes interactive sessions and gamified digital experiences that allow students to engage directly with financial professionals, fostering a dynamic learning environment.

Speaking at the launch event, Esther Waititu, Chief Financial Services Officer at Safaricom PLC noted that Kenya’s financial ecosystem has transformed in the last decade to include a wider range of financial services and digital finance enabling any time anywhere access and making financial literacy an important aspect for a financially healthy society.

“Kenya has a youthful population, which means young people play a major role in economic growth now and in the future. As such it is important to build their financial capabilities. And this requires a concerted effort from the public, private, and social sectors.”

“Financial literacy is essential to financial stability, which is one of our main objectives,” added Esther, while explaining the rationale for the toolkit. “The younger people acquire financial health, the more likely they are to make sound decisions about money. They are more likely to save for a rainy day, to invest wisely, to borrow judiciously when necessary. And they are less likely to fall prey to fraud or predatory practices. M-PESA Go, offers young people aged 13 -17 years a platform to save, make transactions and practice financial wellness at a young age for a money smart generation.”

In his remarks, Arthur Oginga, Group CEO Old Mutual stated, “We must act now to nurture a healthy relationship between young people and money, promote financial resilience, and cultivate overall financial wellness. Without proper preparation, we risk perpetuating a cycle of instability for the next generations. By prioritizing financial education, we will empower these young individuals to develop sound financial habits that will serve them throughout their lives. This is why we are investing resources to support integration of financial education across curricula.”

“The partnership between Old Mutual and Safaricom signifies the potential of leveraging each organization’s unique strengths to foster positive change in our communities. Our shared commitment to digital innovation and a deep understanding of the financial landscape enables us to develop impactful solutions that improve lives”, said Arthur Oginga,

“By prioritizing financial education, we will empower our young learners to develop sound financial habits that will serve them throughout their lives. This is why we are investing resources to support integration of financial education across curricula,” he added.

The toolkit was developed in response to the need to mainstream financial literacy education through the existing school curricula. Learners can download the toolkit on the M-PESA Go and Old Mutual websites.