Equity Bank has introduced an unsecured overdraft facility for its customers. The facility, dubbed Boostika, is similar to Safaricom’s Fuliza and allows customers to overdraw up to Ksh 100,000 from their accounts. This can be used for purchases, sending money and buying airtime when a customer does not have enough money at that specific moment.

Equity Bank, being one of the leading financial institutions in Kenya, has helped shape Kenya’s financial sector over the years. The introduction of Boostika is just the latest addition.

Equity Boostika

As mentioned above, Equity Boostika lets customers overdraw up to ksh 100,000. The lowest a customer can overdraw is ksh 100 and the highest is 100k.

To quality for Boostika, your account must have been active for at least 6 months. The amount you can overdraw (between 100 – 100k) depends on your loan limit which depends on your account activity.

Customers can draw multiple overdrafts as long as the overdraft balance is within their limit. Bootika can be accessed through Equity Mobile App, Equitel or by dialing *247#.

Boostika Charges

Boostika attracts a cost of 8.5% of the amount withdrawn. From this total cost:

- 5% is what Equity refers to as the processing fee

- 1.5% if the interest per month

- 1% is the loan insurance

- The processing fee is subjected to 20% excise duty.

Boostika Vs Fuliza

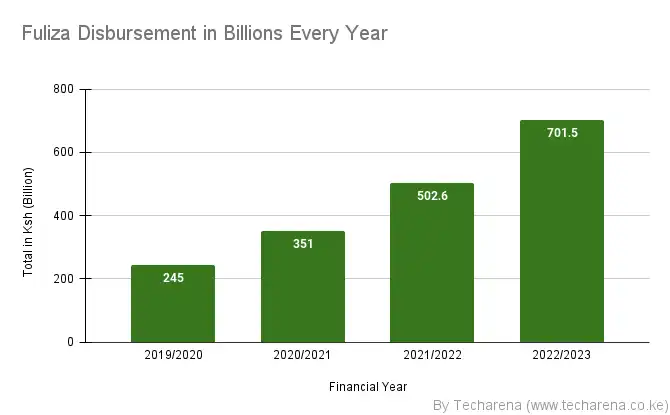

Fuliza may be Boostika’s main competitor at the moment. With Boostika, you can borrow any amount between 100 and 100K. On Fuliza, you can overdraw any amount between Ksh 1 and Ksh 70,000.

Fuliza charges vary depending on the amount borrowed while Boostika charges 8.5% for overdrafts.

Let us take an example of an individual borrowing Ksh 10,000 for a month. On Boostika, the customer will pay Ksh 850 total as the overdraft fee. This includes the Ksh 500 processing fee, Ksh 150 interest and Ksh 100 loan insurance and Ksh 100 excise duty on processing fee. In total, the customer pays back Ksh 10,850.

If a customer borrows ksh 10,000 on Fuliza, they will pay ksh 1000. This includes the Ksh 100 access fee, daily maintenance fee of ksh 25 adding up to Ksh 750 total for 30 days and Ksh 20 as the excise duty (20% of access fee) on the access fee. In total, the customer pays back Ksh 10,870.

Fuliza rates vary depending on the amount overdrawn and it is cheaper when you overdraw large amounts.

Read: Safaricom Launches Fuliza Ya Biashara in Partnership with KCB