Safaricom has revealed that it has reached 50 million monthly active customers on its mobile money service, M-Pesa. This is quite a huge number and makes it one of the largest fintech products in Africa,

This new milestone has been reached in just 18 months since the launch of the M-Pesa Africa joint venture with Vodacom. This new venture is meant to accelerate growth of the service across Africa. M-Pesa was first launched 14 years ago in Kenya and is now available in Tanzania, Mozambique, DRC, Lesotho, Ghana and Egypt too.

“14 years ago, we launched M-PESA to connect our customers to each other and to different opportunities. We are delighted to celebrate this remarkable milestone with our more than 50 million customers across the continent. As an honour to this achievement, we are reiterating our commitment and deepening our focus on more innovations that will further transform the lives of our customers,” said Sitoyo Lopokoiyit, MD – M-PESA Africa.

M-Pesa has evolved over the years ever since it was first introduced back in 2007. The service gained popularity as it provided a better alternative to the financial services we had at the moment. It allowed and still allows people to easily send and receive money to anyone across the country. With traditional financial institutions being way too expensive, M-Pesa was seen as a much better alternative.

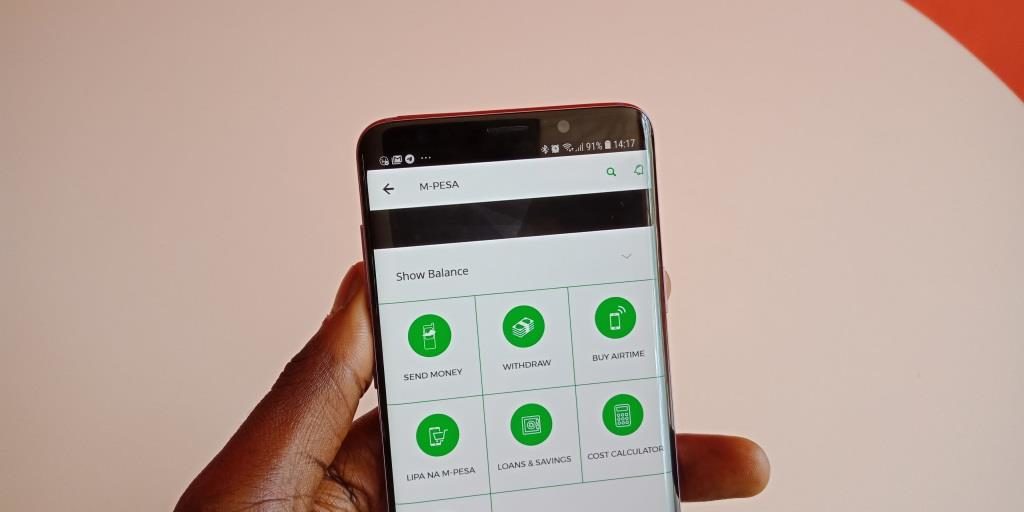

Today, M-PESA is a 2-sided network that provides a wide variety of financial services to both businesses and individual customers. Customers can send and receive money, make and receive business payments, pay bills, make and receive international money transfers, save and access credit, all from the convenience of their mobile phones and wherever they may be in the countries served across more than 500,000 agents.

In June 2021, M-PESA began rolling out the M-PESA Super App across all its markets. The M-PESA Super App introduced one of the service’s key innovations in the form of Mini-Apps which enable customers and businesses to accomplish day-to-day tasks from shopping to accessing government services without having to download different apps for each task.

Also Read: What You Need to Know About the M-PESA Super App Launched by Safaricom