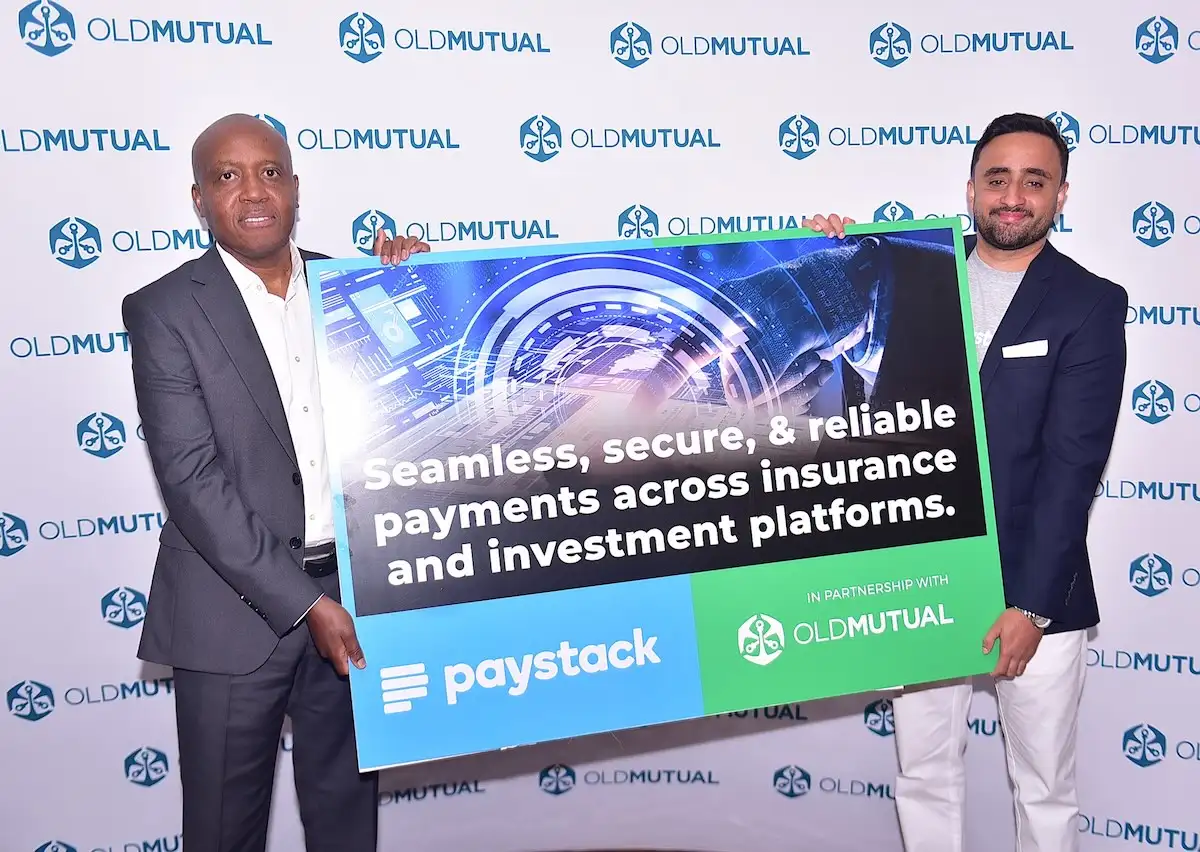

Old Mutual Group has announced a new partnership with Paystack aimed at simplifying and also strengthening digital payments across its insurance and investment platforms in East Africa.

The integration allows customers to complete transactions faster and securely through different online and mobile payment channels. This will help reduce friction at the point of payment and in the end improve the digital customer journey. Old Mutual hopes this will improve conversion rates, reduce failed transactions and enhance operational efficiency across its growing digital ecosystem.

“At Old Mutual, we are committed to delivering exceptional digital experiences for our customers. Partnering with Paystack allows us to provide a seamless payment journey, reinforcing our focus on customer convenience and innovation in financial services,” said Andrew Mwithiga, Head of Digital, Innovation, and Analytics at Old Mutual East Africa.

“We are pleased to partner with Old Mutual to enhance its digital payment capabilities. Our platform is designed to simplify payments and we look forward to supporting Old Mutual in delivering a modern and efficient digital experience for its customers,” said Vikaran Ubhi, Chief Technology Officer at Paystack.

The collaboration forms part of Old Mutual’s broader digital transformation strategy. The company has been expanding its digital platforms to support insurance, investment and advisory services across the region. In 2025, Old Mutual unveiled a new platform dubbed Anchor 360 with the aim of digitising portfolio management across teh markets it operates in. The platform sims to improve access to financial advice and also imporove efficiency around customer and advisor experiences.

Old Mutual is also positioning itself as a more digitally native financial services provider by integrating its modern payment infrastructure like Paystack into its platforms. This is what most customers expect and will help the company align with expectations around speed, convenience and mobile-first interactions.

For these and more stories, follow us on X (Formerly Twitter), Facebook, LinkedIn and Telegram. You can also send us tips or reach out at [email protected].

Also Read: Old Mutual Kenya Delivers Resilient H1 2025 Results