Sanlam Kenya has unveiled Sanlam Akiba Plus, a mobile-first, tech-driven pension platform designed to make saving for retirement easier, more flexible, and more inclusive for both individuals and businesses.

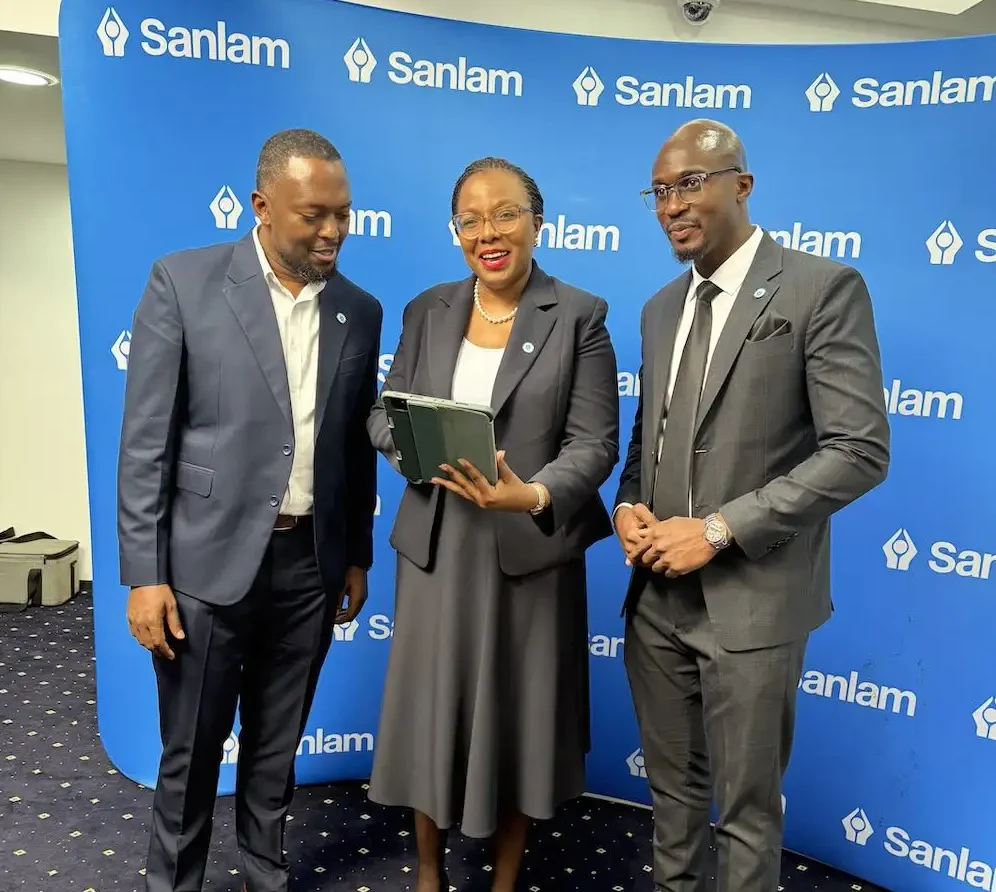

“Our goal with Akiba Plus is to close the pension gap in Kenya by offering a simple, credible, and future-ready solution that works for everyone,” said Jacqueline Karasha, CEO of Sanlam Life, during the launch event in Nairobi. “This is about helping Kenyans save consistently and retire with dignity.”

Unlike traditional pension plans that rely on paperwork and physical onboarding, Akiba Plus lives entirely online. Users can self-register, make contributions and track their investment growth via a web-based or USSD platform.

The platform also integrates a financial planning tool to allow users to set personalized goals.

“If I want to retire in 10 or 15 years, the system can help me calculate how much I need to save today,” Karasha explained. “It’s a game changer for people who want to see what they’re working toward.”

All contributions are guaranteed against capital depreciation, earning a minimum return of 5%, with actual returns reaching up to 15% in 2024. This is one of the highest in the local pension industry, according to the firm.

Targeting Kenya’s Gig Economy

Sanlam sees Akiba Plus as a bridge to the informal and gig economy, where most Kenyans lack structured retirement plans.

“The informal sector is very dynamic, income is irregular,” Karasha noted. “So we had to design a product that’s flexible enough for people to contribute whenever they earn, even as little as KES 500.”

The product suite includes:

- Personal Pension Plans for individuals

- Employer Umbrella Plans for SMEs

- Post-Retirement Medical Funds

- And Tier II Compliant Plans under the NSSF Act

Each is accessible digitally and designed for different saver needs and capacities.

Developer Sandbox

Sanlam is also opening its doors to Kenya’s growing fintech and developer ecosystem. The Akiba Plus platform includes open APIs and a sandbox environment where partners can test, embed, and distribute Sanlam’s pension products within their own systems.

“We’ve launched a platform where partners can sign up, access our sandbox and start experimenting with the APIs we provide,” a Sanlam official said. “You can actually distribute the entire product suite digitally.”

This open architecture could turn Akiba Plus into a hub for embedded insurance innovation, allowing startups, SACCOs, and financial advisors to integrate pension services directly into their platforms.

Sanlam’s data shows growing financial awareness among younger Kenyans, particularly Gen Zs investing in unit trusts and money market funds. Akiba Plus aims to ride that wave.

“Gen Zs want transparency and accessibility,” Karasha said. “They’re financially aware and want control. and that’s what we’ve built into this platform.”

She added that financial wellness sessions will be part of the rollout, helping young savers understand how to balance short-term spending with long-term planning.

Looking Ahead

Sanlam Kenya projects a 40–60% growth in pension signups within the next 12 months, buoyed by partnerships with intermediaries and financial advisors embedding Akiba Plus into their ecosystems.

“Our goal is not just to digitize pension access but to restore dignity in retirement,” Karasha said. “With Akiba Plus, we want to make retirement planning something every Kenyan can relate to.”

By combining a USSD gateway, open APIs, and in-app financial planning tools, Sanlam is blurring the line between insurance and fintech. Akiba Plus could mark a turning point for digital pensions in Kenya.

For these and more stories, follow us on X (Formerly Twitter), Facebook, LinkedIn and Telegram. You can also send us tips or reach out at info@techarena.co.ke.