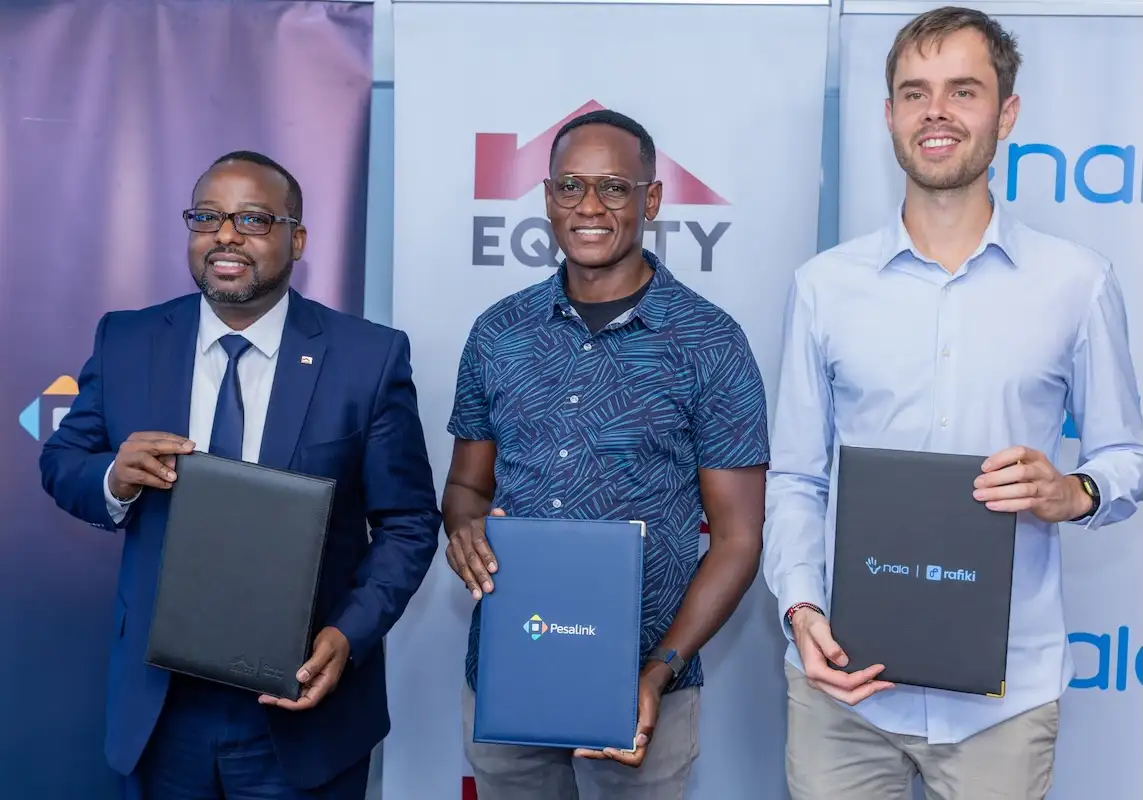

PesaLink, NALA and Equity Bank have partnered to make it easier for Kenyans abroad to send money back home. This partnership will help deliver funds instantly to mobile wallets and bank accounts across the country.

Last year, Kenyans in the diaspora sent home $4.94 billion. This makes remittances one of the top sources of foreign exchange for the country. Even with that, sending money across borders is often expensive and slow, with fees and delays eating into the amount families actually receive.

This partnership will combine PesaLink’s instant payment infrastructure that supports transfers of up to Ksh 999,999 across 80+ banks, SACCOs, telcos and fintechs with

NALA’s global fintech platform and Equity Bank’s extensive local network and settlement infrastructure to ensure smooth last-mile delivery.

Diaspora senders simply use the NALA app to initiate transfers. Money is routed directly through PesaLink’s trusted rails and delivered to recipients in seconds. This can be directly to bank accounts or mobile wallets.

“By digitizing remittance flows, we’re expanding access for underserved communities,” said Samuel Ireri, Equity Group Head of International Banking & Payments, noting that the initiative aligns with Equity’s Africa Recovery and Resilience Plan.

Kenn Lisudza, Chief Products Officer at IPSL (the company behind PesaLink), added that reducing friction in cross-border payments increases trust and inclusion for millions of users.

Nicolai Eddy, COO of NALA, emphasized the global impact, “Billions are lost annually to cross-border payment fees. By partnering with the right infrastructure players, we can make payments faster, more reliable, and affordable for everyone.”

For these and more stories, follow us on X (Formerly Twitter), Facebook, LinkedIn and Telegram. You can also send us tips or reach out at [email protected].

Also Read: Pesalink and The Fintech Alliance Sign MOU to improve Instant Payments and Interoperability in Kenya