PalmPay has today announced the launch of its USSD code in Nigeria.

This service offers Nigerians an additional way to manage their finances without the need for internet connectivity. With the PalmPay USSD code, customers can now perform a wide range of banking transactions by dialing *861# from their mobile phones.

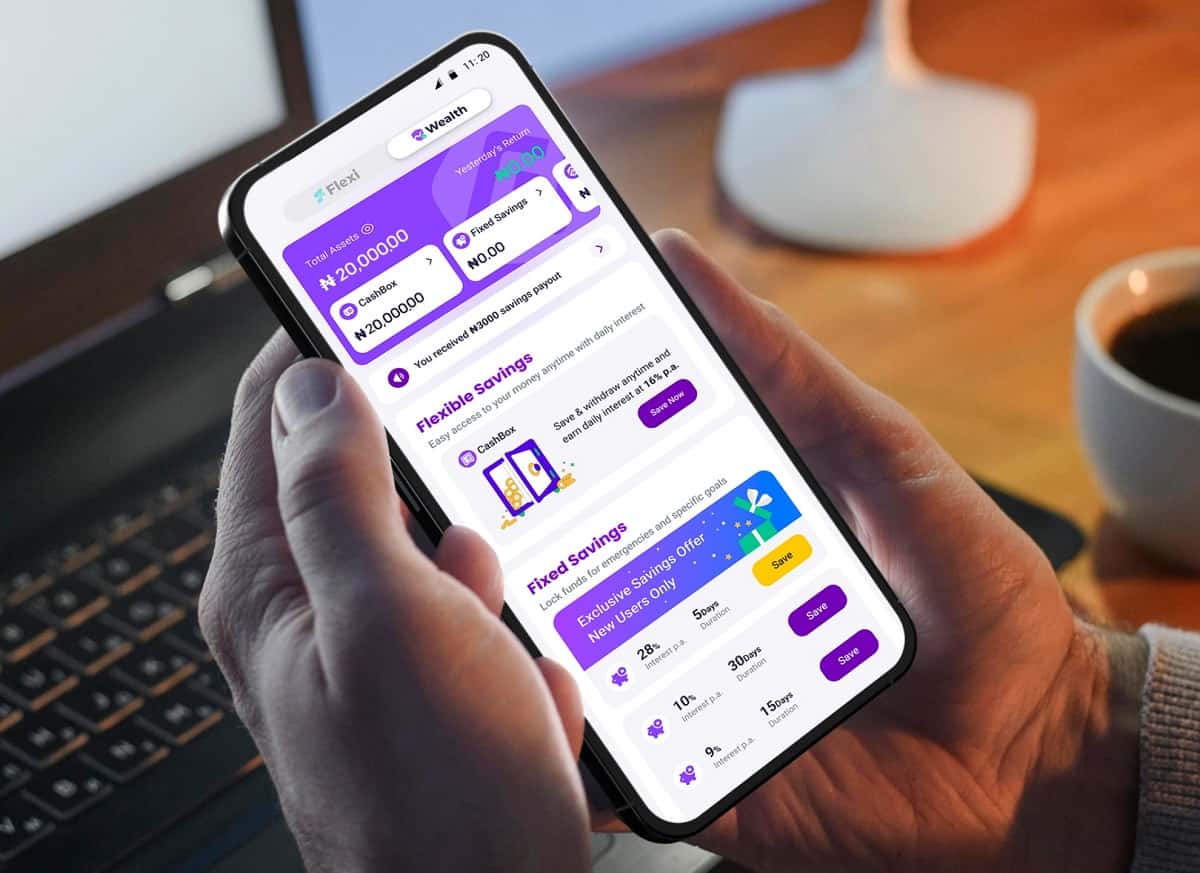

PalmPay has been operating in Nigeria since 2019 under a Mobile Money Operator license issued by the CBN. The fintech pioneered a model that provides financial services such as money transfers, bill payments, credit services and savings via a one-stop-shop financial ‘superapp’.

Customers without access to smartphones are able to make transactions via a nationwide network of over 500,000 Mobile Money Agents. The addition of a USSD access point is designed to further enhance the accessibility and convenience of its platform for consumers in a market where data network outages are common.

Chika Nwosu, Nigeria Managing Director, emphasized the company’s commitment to financial inclusion “At PalmPay, we aim to bridge the gap in digital access, and the introduction of our USSD service aligns with that mission. Our platform ensures seamless connectivity for our users.” he said. “In addition, our USSD platform comes with a security feature which allows our customers to remotely freeze their accounts in case their phone is lost or stolen, providing an extra layer of protection to safeguard their finances.”

PalmPay has achieved significant milestones in Nigeria, reaching over 30 million registered users on its app and connecting 1.1 million businesses through its network of mobile money agents and merchants. The company has been a key driver of financial inclusion in Nigeria, with a third of PalmPay users reporting that they opened their first-ever financial account through the platform.

For these and more stories, follow us on X (Formerly Twitter), Facebook, LinkedIn and Telegram. You can also send us tips or just reach out on [email protected].

Also Read: PalmPay Named Among Top 250 Fintech Companies in the World by CNBC and Statista