In Kenya, mobile money interoperability has been a game-changer in the financial landscape, enhancing inclusion and economic growth. By allowing seamless transactions between different mobile money providers, it has broken down barriers and opened up new opportunities for millions of people, empowering individuals and communities across the country.

Kenya has been at the forefront of mobile money innovation since the early 2000s, starting with the launch of M-Pesa. Yet, transferring money between different mobile networks has long been challenging, involving extra costs and complex procedures. However, with the introduction of mobile money interoperability this situation has improved. Now, Kenyans can seamlessly transfer money between different service providers, simplifying everyday transactions and enhancing accessibility for all.

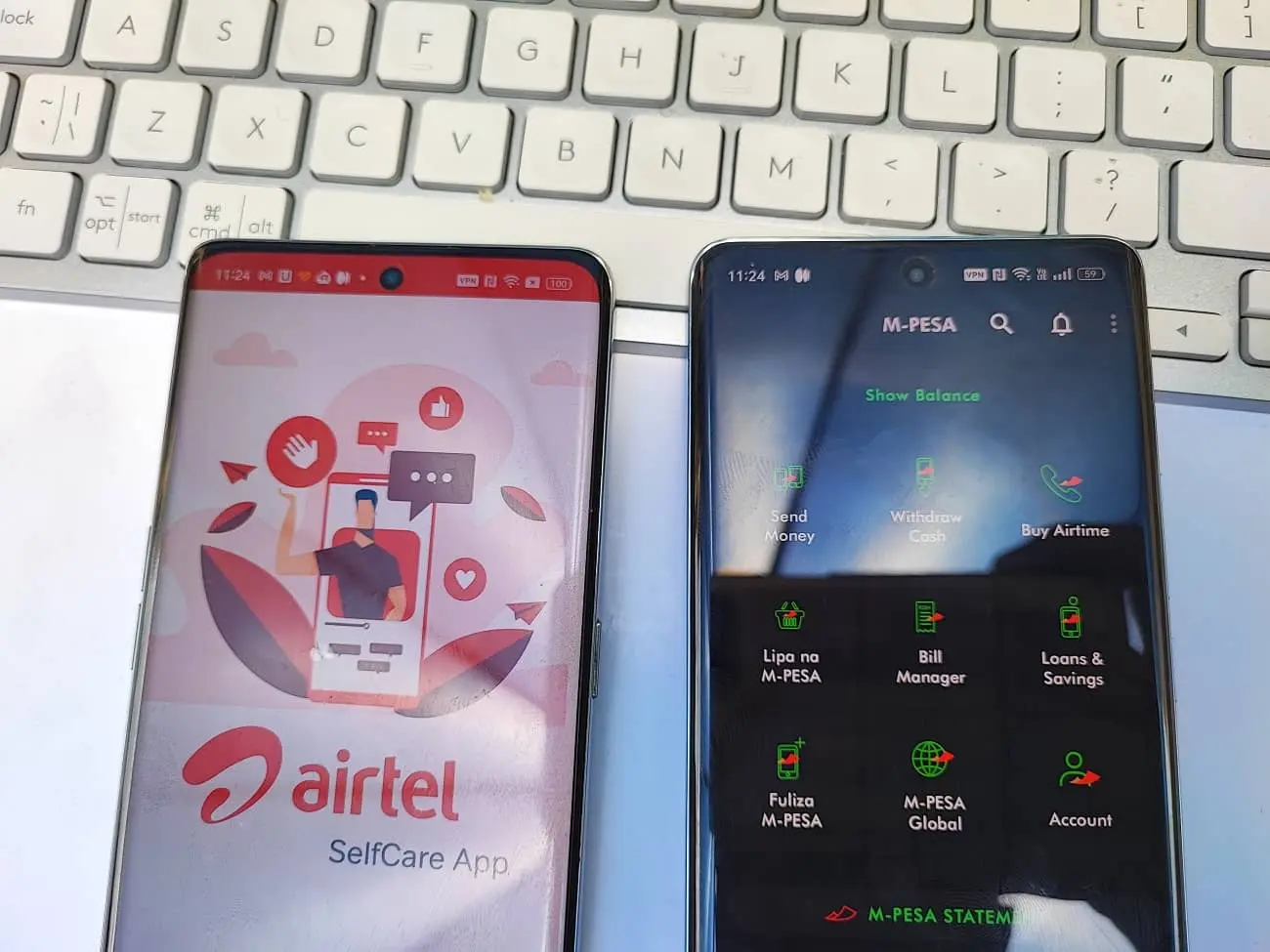

The Central Bank of Kenya (CBK) played a pivotal role in driving this change. In its National Payments Strategy Plan for 2022–2025, the CBK emphasised the importance of making transactions between networks smooth and hassle-free. For instance, thanks to interoperability, Airtel Money users can now receive funds directly from any other network without needing cumbersome withdrawal codes. This means that everyone, from the busy trader in Mombasa to the farmer in Kisii, can benefit from easy mobile transactions. Further to this, Airtel Money customers can now utilise funds received from MPESA across the digital ecosystem, be it wallet to bank transactions, paying bills, or transferring money. Prior to these expanded benefits of interoperability, Airtel customers were forced to withdraw the money and handle it in its cash form.

The economic impact of mobile money interoperability in Kenya is profound. Majority who were previously excluded from the financial system can now access a wide range of financial services, from making purchases to saving and borrowing money. This shift is particularly significant for those operating in the informal economy, a substantial contributor to Kenya’s GDP.

For small traders, farmers, and vendors, the ability to accept payments from any network has been transformative. This convenience not only boosts sales but also reduces reliance on cash, enhancing security and financial inclusion.

Moreover, the interconnected mobile money system has spurred a wave of financial innovation. New technologies and services are emerging to meet the diverse needs of Kenyans, from micro-insurance to investment platforms, all while creating employment, attracting investment, and positioning Kenya as a fintech hub in Africa.

Looking ahead, the focus is on sustaining and expanding these gains. Potential initiatives include integrating mobile money with global financial systems, developing new financial products that cater to the unique needs of different communities, and enhancing cybersecurity measures to protect the growing digital economy.

Kenya’s mobile money revolution is not just about technology, it is about empowering people and boosting the economy. Additionally, it is proof that when we break down barriers and make finance work for everyone, we all win.

Read: How to Send And Receive Money From Abroad Through Airtel Money