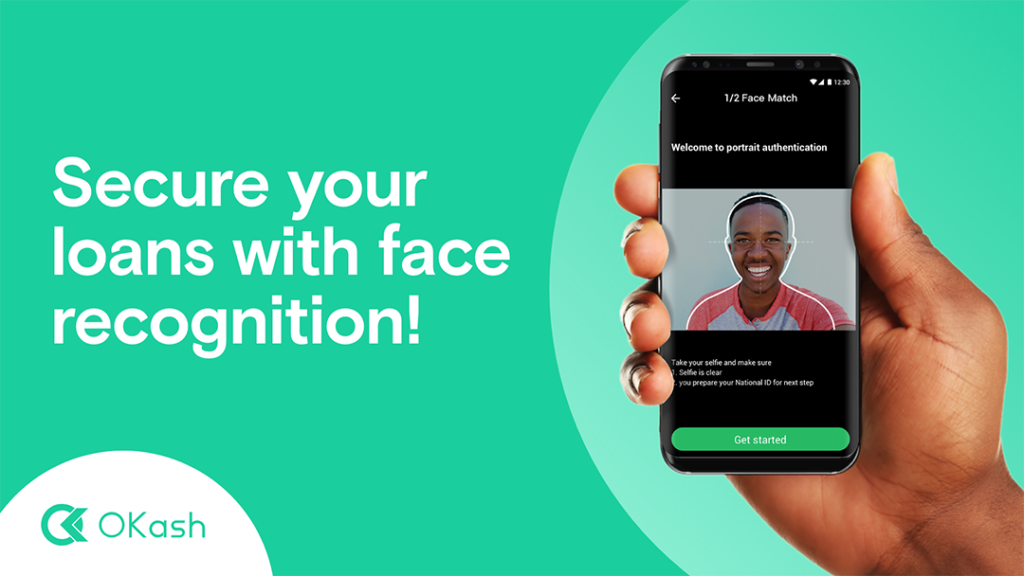

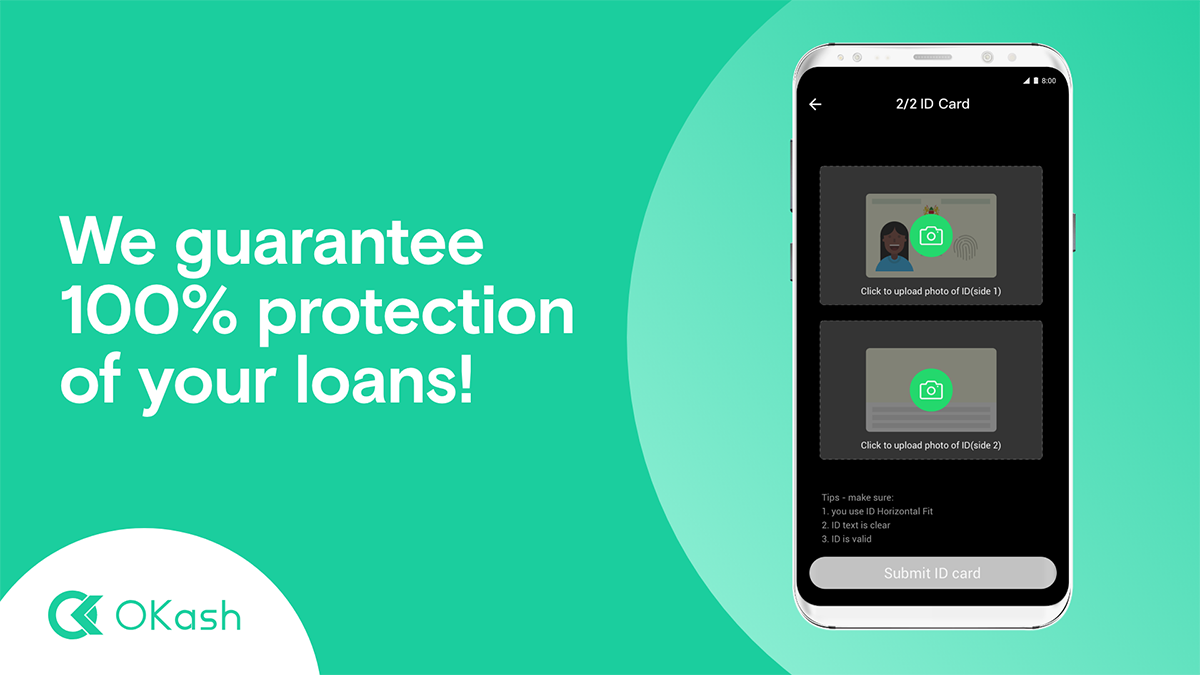

OKash, the microlending app developed by OPay, an affiliated company of the Opera Group, becomes the first microlending app in Kenya to implement an innovative built-in face recognition system, providing users with an extra layer of security when requesting a loan. This new face recognition system has been built to protect the identity of any OKash borrower from potential third-party fraud.

“We are very happy to be the first financial technology app in the country to innovate and establish such a security system” said Edward Ndichu, Managing Director of OKash in Kenya. “Within financial digital services, there is need to ensure that the customer is actually who they say they are. By implementing this new feature, we ensure the integrity of our customers and guarantee them 100 percent protection of their loans and personal information when using the app.”

With one of the fastest growing digital economies in the world, Kenyan mobile financial technology providers face multiple challenges by scammers who use personal information such as a phone or ID number to get a loan using someone else identity.

According to the 2017 Annual Report presented by the Financial Sector Deepening (FSD) in Kenya, more than 73 percent of citizens have a mobile money account. This represents a major part of Kenya’s population that is vulnerable to digital fraud.

“This new face recognition system has been designed to protect the identity of all our users and provide them with the best experience,” said Ndichu. “We would like to encourage all of our users to test the new feature and start protecting their daily loans and transactions.”

Also Read: Opera News Reaches 10 Million Users In Africa Thanks To World Cup Features